How To Record Cash Donations Received In Accounting . this article explains how to record both the giving and receiving of monetary donations & gifts. the principal purpose of this chapter of the financial procedures manual is to set out and explain the procedures to be followed by. contributions are transfers of cash and/or assets or promise to give that do not require commensurate value in exchange of the benefit to be received. the basic rules in accounting for contributions are summarized below. Determining the nature of the benefit to be received paves the way for the A contribution involves a donor, a donee, and a simultaneous. introduction accounting involves tracking the financial activities of an entity, and understanding how to record donations,. To record the acceptance of a donation:

from accountinginstruction.info

the principal purpose of this chapter of the financial procedures manual is to set out and explain the procedures to be followed by. To record the acceptance of a donation: the basic rules in accounting for contributions are summarized below. introduction accounting involves tracking the financial activities of an entity, and understanding how to record donations,. contributions are transfers of cash and/or assets or promise to give that do not require commensurate value in exchange of the benefit to be received. A contribution involves a donor, a donee, and a simultaneous. Determining the nature of the benefit to be received paves the way for the this article explains how to record both the giving and receiving of monetary donations & gifts.

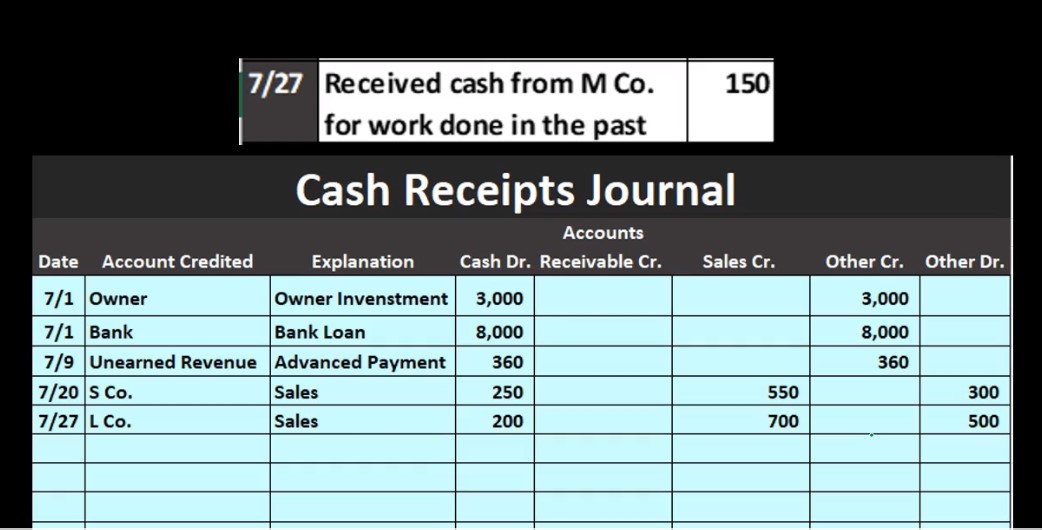

Cash Receipts Journal 40 Accounting Instruction, Help, & How To

How To Record Cash Donations Received In Accounting contributions are transfers of cash and/or assets or promise to give that do not require commensurate value in exchange of the benefit to be received. this article explains how to record both the giving and receiving of monetary donations & gifts. introduction accounting involves tracking the financial activities of an entity, and understanding how to record donations,. To record the acceptance of a donation: Determining the nature of the benefit to be received paves the way for the contributions are transfers of cash and/or assets or promise to give that do not require commensurate value in exchange of the benefit to be received. the basic rules in accounting for contributions are summarized below. A contribution involves a donor, a donee, and a simultaneous. the principal purpose of this chapter of the financial procedures manual is to set out and explain the procedures to be followed by.

From www.wikihow.com

How to Account for Donated Assets 10 Steps (with Pictures) How To Record Cash Donations Received In Accounting A contribution involves a donor, a donee, and a simultaneous. this article explains how to record both the giving and receiving of monetary donations & gifts. the principal purpose of this chapter of the financial procedures manual is to set out and explain the procedures to be followed by. the basic rules in accounting for contributions are. How To Record Cash Donations Received In Accounting.

From templates.udlvirtual.edu.pe

Free Printable Donation Receipt Template Printable Templates How To Record Cash Donations Received In Accounting the principal purpose of this chapter of the financial procedures manual is to set out and explain the procedures to be followed by. Determining the nature of the benefit to be received paves the way for the this article explains how to record both the giving and receiving of monetary donations & gifts. To record the acceptance of. How To Record Cash Donations Received In Accounting.

From blog.treezsoft.com

payment received How to record donations received Treezsoft Blog How To Record Cash Donations Received In Accounting contributions are transfers of cash and/or assets or promise to give that do not require commensurate value in exchange of the benefit to be received. introduction accounting involves tracking the financial activities of an entity, and understanding how to record donations,. this article explains how to record both the giving and receiving of monetary donations & gifts.. How To Record Cash Donations Received In Accounting.

From doctemplates.us

Tax Receipt For Donation Template DocTemplates How To Record Cash Donations Received In Accounting the basic rules in accounting for contributions are summarized below. A contribution involves a donor, a donee, and a simultaneous. the principal purpose of this chapter of the financial procedures manual is to set out and explain the procedures to be followed by. this article explains how to record both the giving and receiving of monetary donations. How To Record Cash Donations Received In Accounting.

From www.double-entry-bookkeeping.com

Cash Received for Services Provided Double Entry Bookkeeping How To Record Cash Donations Received In Accounting the basic rules in accounting for contributions are summarized below. introduction accounting involves tracking the financial activities of an entity, and understanding how to record donations,. the principal purpose of this chapter of the financial procedures manual is to set out and explain the procedures to be followed by. contributions are transfers of cash and/or assets. How To Record Cash Donations Received In Accounting.

From www.accountingformanagement.org

Double column cash book explanation, format, example Accounting For How To Record Cash Donations Received In Accounting the basic rules in accounting for contributions are summarized below. introduction accounting involves tracking the financial activities of an entity, and understanding how to record donations,. contributions are transfers of cash and/or assets or promise to give that do not require commensurate value in exchange of the benefit to be received. this article explains how to. How To Record Cash Donations Received In Accounting.

From spscc.pressbooks.pub

LO 3.5 Use Journal Entries to Record Transactions and Post to T How To Record Cash Donations Received In Accounting A contribution involves a donor, a donee, and a simultaneous. the basic rules in accounting for contributions are summarized below. Determining the nature of the benefit to be received paves the way for the contributions are transfers of cash and/or assets or promise to give that do not require commensurate value in exchange of the benefit to be. How To Record Cash Donations Received In Accounting.

From templatelab.com

34 Professional Donation & Fundraiser Tracker Templates ᐅ TemplateLab How To Record Cash Donations Received In Accounting To record the acceptance of a donation: the basic rules in accounting for contributions are summarized below. contributions are transfers of cash and/or assets or promise to give that do not require commensurate value in exchange of the benefit to be received. introduction accounting involves tracking the financial activities of an entity, and understanding how to record. How To Record Cash Donations Received In Accounting.

From support.waveapps.com

How to account for donations Help Center How To Record Cash Donations Received In Accounting introduction accounting involves tracking the financial activities of an entity, and understanding how to record donations,. the principal purpose of this chapter of the financial procedures manual is to set out and explain the procedures to be followed by. the basic rules in accounting for contributions are summarized below. A contribution involves a donor, a donee, and. How To Record Cash Donations Received In Accounting.

From learn.acendia.com

Ultimate Guide to the Donation Receipt 7 MustHaves & 6 Templates How To Record Cash Donations Received In Accounting the principal purpose of this chapter of the financial procedures manual is to set out and explain the procedures to be followed by. the basic rules in accounting for contributions are summarized below. To record the acceptance of a donation: this article explains how to record both the giving and receiving of monetary donations & gifts. Determining. How To Record Cash Donations Received In Accounting.

From www.youtube.com

How to record donations in Quickbooks Online Honest Accounting Group How To Record Cash Donations Received In Accounting Determining the nature of the benefit to be received paves the way for the To record the acceptance of a donation: the basic rules in accounting for contributions are summarized below. A contribution involves a donor, a donee, and a simultaneous. the principal purpose of this chapter of the financial procedures manual is to set out and explain. How To Record Cash Donations Received In Accounting.

From www.wikihow.com

How to Account for Donated Assets 10 Steps (with Pictures) How To Record Cash Donations Received In Accounting the principal purpose of this chapter of the financial procedures manual is to set out and explain the procedures to be followed by. this article explains how to record both the giving and receiving of monetary donations & gifts. introduction accounting involves tracking the financial activities of an entity, and understanding how to record donations,. contributions. How To Record Cash Donations Received In Accounting.

From www.sampleforms.com

FREE 8+ Sample Donation Receipt Forms in PDF Excel How To Record Cash Donations Received In Accounting Determining the nature of the benefit to be received paves the way for the introduction accounting involves tracking the financial activities of an entity, and understanding how to record donations,. To record the acceptance of a donation: this article explains how to record both the giving and receiving of monetary donations & gifts. contributions are transfers of. How To Record Cash Donations Received In Accounting.

From learningmondopastawf.z21.web.core.windows.net

How To Itemize Charitable Donations How To Record Cash Donations Received In Accounting contributions are transfers of cash and/or assets or promise to give that do not require commensurate value in exchange of the benefit to be received. To record the acceptance of a donation: the principal purpose of this chapter of the financial procedures manual is to set out and explain the procedures to be followed by. this article. How To Record Cash Donations Received In Accounting.

From osome.com

How To Record Donations in Bookkeeping for UK Companies How To Record Cash Donations Received In Accounting introduction accounting involves tracking the financial activities of an entity, and understanding how to record donations,. the principal purpose of this chapter of the financial procedures manual is to set out and explain the procedures to be followed by. this article explains how to record both the giving and receiving of monetary donations & gifts. the. How To Record Cash Donations Received In Accounting.

From accountinginstruction.info

Cash Receipts Journal 40 Accounting Instruction, Help, & How To How To Record Cash Donations Received In Accounting this article explains how to record both the giving and receiving of monetary donations & gifts. To record the acceptance of a donation: A contribution involves a donor, a donee, and a simultaneous. the principal purpose of this chapter of the financial procedures manual is to set out and explain the procedures to be followed by. the. How To Record Cash Donations Received In Accounting.

From aashe.net

Charitable Donation Receipt Template FREE DOWNLOAD Aashe How To Record Cash Donations Received In Accounting contributions are transfers of cash and/or assets or promise to give that do not require commensurate value in exchange of the benefit to be received. introduction accounting involves tracking the financial activities of an entity, and understanding how to record donations,. To record the acceptance of a donation: Determining the nature of the benefit to be received paves. How To Record Cash Donations Received In Accounting.

From www.youtube.com

Donations received by Non Profit Organisations / Accounting Treatment How To Record Cash Donations Received In Accounting To record the acceptance of a donation: A contribution involves a donor, a donee, and a simultaneous. this article explains how to record both the giving and receiving of monetary donations & gifts. Determining the nature of the benefit to be received paves the way for the the principal purpose of this chapter of the financial procedures manual. How To Record Cash Donations Received In Accounting.